—

# The Case for Boring Budgets: Why Stability is Key in Economic Planning

## Understanding the Budgeting Process

Budgets are essential documents that outline a government’s planned revenues and expenditures for a specific period, usually a year. They are crucial for economic stability and growth, as they dictate how public resources are allocated. However, this year’s budget buildup has been anything but straightforward, characterized by uncertainty and protracted debates. Economists and policymakers alike have expressed concerns over this chaotic approach, emphasizing the need for a more stable and predictable budgeting process moving forward.

## The Chaos of the Current Budget Cycle

The recent budget buildup has been described as one of the most tumultuous in recent history. This prolonged uncertainty can lead to negative consequences for both the economy and public confidence. When budgets are not finalized in a timely manner, it can create volatility in financial markets, discourage investment, and lead to inefficiencies in public service delivery.

### Causes of the Chaotic Budget Buildup

Several factors contributed to the chaotic nature of this year’s budget process:

1. **Political Divisions**: Disagreements among political parties over taxation and spending priorities have led to delays and uncertainty.

2. **Economic Pressures**: Rising inflation and fluctuating global markets have made it challenging to project future revenues and expenditures accurately.

3. **Public Expectations**: Citizens are increasingly vocal about their needs, leading to pressure on governments to address various social issues, further complicating the budgeting process.

## The Need for Reassurance: Why Boring Budgets Matter

In the world of finance, predictability is paramount. A stable budget process can lead to the following benefits:

– **Investor Confidence**: Investors prefer environments where they can anticipate government actions, as it allows for better planning and risk assessment.

– **Economic Growth**: A predictable budget fosters a stable economic environment, which is conducive to business investment and consumer spending.

– **Public Trust**: When budgets are managed effectively and transparently, it enhances public trust in governmental institutions and their ability to manage resources.

### Actionable Takeaways for Financial Professionals

As we look ahead to future budgets, there are several key strategies that financial professionals can adopt to advocate for a more stable budgeting environment:

1. **Promote Transparency**: Encourage governmental bodies to provide clear, accessible information about budget processes and decisions. This can help demystify the budgeting process and build public trust.

2. **Engage in Advocacy**: Financial professionals should engage with policymakers to advocate for more streamlined and predictable budget processes. This could involve supporting fiscal policies that prioritize long-term planning over short-term political gains.

3. **Monitor Economic Indicators**: Keep a close watch on economic trends, such as inflation rates and employment statistics. Understanding these indicators can help in forecasting potential budget impacts and preparing for economic shifts.

4. **Educate Stakeholders**: Providing workshops or informational sessions on the importance of stable budgeting can empower stakeholders, including business leaders and community members, to advocate for effective fiscal policies.

## Conclusion: A Call for Stability

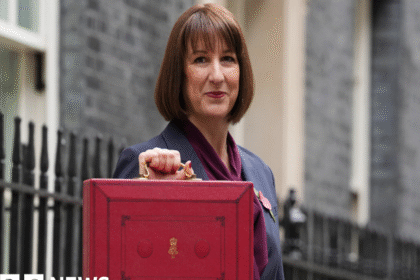

As Rachel Reeves prepares to present the upcoming tax-and-spend statement, the hope is for a bold yet stabilizing approach that can lay the groundwork for future budgets that are reassuringly dull—free from the chaos of this year’s buildup. Emphasizing stability and predictability will not only benefit investors and businesses but also foster a healthier economic environment for all citizens.