**SEO_TITLE:** Trump on Putin and Xi: A New Approach to Global Superpower Relations

**META_DESC:** In a recent CBS interview, Trump discusses his views on Putin and Xi, highlighting their leadership styles and potential for future U.S. relations with Russia and China. Discover the implications for global finance and trade.

**TAGS:** Trump, Putin, Xi Jinping, US-China relations, US-Russia relations, global trade, finance news

—

### Trump’s Perspective on Global Superpowers: Key Takeaways

In a recent interview on CBS’s “60 Minutes,” former President Donald Trump shared his thoughts on two of the world’s leading superpowers: Russia and China. His comments not only reflect his personal views but could also signal shifts in U.S. foreign policy that may have broad implications for global markets and trade relations.

### Understanding the Superpower Dynamics

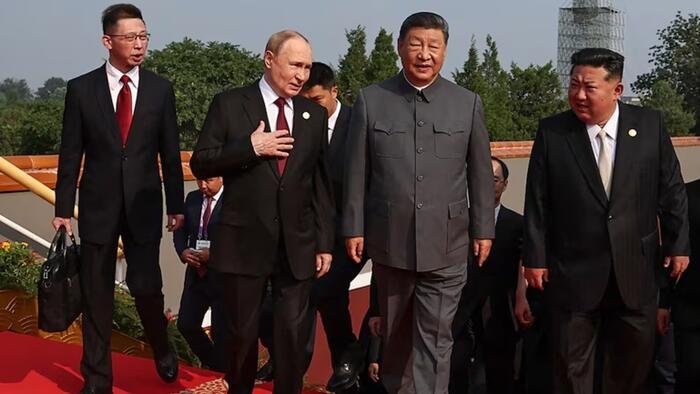

Trump described both Russian President Vladimir Putin and Chinese President Xi Jinping as “very strong leaders” who are “tough” and “smart.” He emphasized that these leaders are “not to be toyed with,” indicating a respect for their strategic capabilities. This characterization suggests that any U.S. policy decisions regarding these nations must be approached with caution and strategic foresight.

**Actionable Takeaway:** Investors and businesses should remain vigilant about geopolitical developments involving these nations, as their actions can significantly influence global markets, particularly in sectors like energy, technology, and defense.

### The Russia-Ukraine Conflict: A New Perspective

Trump asserted that the ongoing Russia-Ukraine war would not have occurred under his administration, pointing to a perceived failure in U.S. leadership under President Biden. He noted that Putin believes he is winning the conflict, further complicating the potential for resolution. Trump’s statement that he hopes for a truce “in a couple of months” appears optimistic given the current realities on the ground.

**Actionable Takeaway:** Stakeholders in the energy and commodities markets should prepare for continued volatility stemming from the conflict. Any shifts in U.S. foreign policy or negotiations could impact energy prices and supply chains.

### Trade Relations with China: Tariffs and Rare-Earth Minerals

In discussing China, Trump highlighted the ongoing trade tensions, particularly regarding rare-earth minerals. He claimed that the U.S. currently faces “no rare-earth threat,” attributing this stability to high tariffs that have generated significant revenue for the U.S. economy. With tariffs approaching 50%, the implications for American manufacturers and consumers could be substantial.

**Actionable Takeaway:** Businesses reliant on rare-earth minerals should consider diversifying their supply chains or exploring domestic alternatives to mitigate risks associated with tariffs and trade disputes.

### A Shift in Rhetoric

Interestingly, Trump’s tone in the CBS interview marks a notable shift from his previous remarks, where he accused Xi of “conspiring against” the U.S. This more conciliatory tone suggests a potential pivot back to Trump’s earlier identity as a “peace president,” focused on deal-making rather than conflict escalation.

**Actionable Takeaway:** Investors should monitor the evolving rhetoric from U.S. leaders, as changes in diplomatic tone can lead to fluctuations in market sentiment and investment strategies.

### Conclusion: The Path Forward

As Trump navigates the complex relationships with Putin and Xi, the potential for major shifts in U.S. foreign policy remains high. The implications for global trade, energy prices, and market stability are significant. Stakeholders across various sectors should remain proactive in adapting to these changes, ensuring they are prepared for the potential impacts on their investments and operations.

In summary, the dynamics of U.S. relations with Russia and China are not just political; they are economic forces that can shape the financial landscape for years to come.