**SEO_TITLE:** Understanding the Latest Financial Market Trends: Key Insights and Strategies

**META_DESC:** Discover the latest trends in financial markets, key terminology explained, and actionable strategies for investors to navigate current conditions.

**TAGS:** financial news, market trends, investment strategies, economic indicators, stock market analysis

—

# Understanding the Latest Financial Market Trends: Key Insights and Strategies

In the ever-evolving world of finance, staying updated on market trends is crucial for investors. This article breaks down key terms, explores the causes and effects of current market dynamics, and provides actionable takeaways for navigating these conditions.

## Key Terms Explained

### 1. **Interest Rates**

Interest rates are the cost of borrowing money, typically expressed as a percentage. When central banks, like the Federal Reserve in the U.S., adjust interest rates, it impacts borrowing costs for consumers and businesses. Lower rates can stimulate economic growth by making loans cheaper, while higher rates can cool down an overheating economy.

### 2. **Inflation**

Inflation refers to the rate at which the general level of prices for goods and services rises, eroding purchasing power. Central banks aim to control inflation to maintain economic stability. When inflation is high, it can lead to increased interest rates, which may slow down economic activity.

### 3. **Stock Market Volatility**

Volatility indicates how much the price of a security, such as stocks, fluctuates. High volatility can signal uncertainty in the market, often driven by economic indicators, geopolitical events, or changes in fiscal policy. Understanding volatility helps investors gauge risk and potential returns.

## Causes of Current Market Trends

### Economic Recovery from the Pandemic

As economies recover from the COVID-19 pandemic, there has been a surge in consumer spending, which is a key driver of economic growth. This recovery is reflected in rising stock prices, particularly in sectors like travel, hospitality, and retail. However, this rapid growth has also raised concerns about inflation.

### Rising Inflation Rates

Many countries are experiencing rising inflation, driven by supply chain disruptions and increased demand as economies reopen. This situation has led central banks to consider tightening monetary policy by raising interest rates, which could impact borrowing costs and consumer spending.

### Geopolitical Tensions

Ongoing geopolitical tensions, such as those involving major economies, can create uncertainty in financial markets. Investors often react to news about trade agreements, sanctions, or conflicts, which can lead to increased market volatility.

## Effects on the Financial Markets

### Impact on Investment Strategies

As interest rates rise, investors may shift their strategies. For example, they might move away from growth stocks, which often rely on cheap borrowing, and into value stocks, which tend to perform better in a high-interest-rate environment. This shift can lead to a rotation in market leadership.

### Changes in Consumer Behavior

Higher inflation and interest rates can dampen consumer spending as households adjust to higher costs of living. This change can affect corporate earnings, particularly in sectors sensitive to consumer discretionary spending, such as retail and technology.

## Actionable Takeaways for Investors

### Diversify Your Portfolio

In uncertain market conditions, diversification is key. Consider spreading investments across various asset classes, including stocks, bonds, and commodities. This strategy can help mitigate risk and enhance potential returns.

### Stay Informed on Economic Indicators

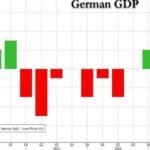

Keep an eye on key economic indicators such as inflation rates, unemployment figures, and GDP growth. These metrics provide insights into the health of the economy and can help guide investment decisions.

### Reassess Risk Tolerance

Given the current volatility, it’s essential to reassess your risk tolerance. Ensure your investment strategy aligns with your financial goals and comfort level with market fluctuations. If necessary, consult with a financial advisor to make informed adjustments.

### Monitor Central Bank Policies

Central bank decisions on interest rates can significantly impact market dynamics. Stay informed about upcoming meetings and policy changes from central banks, as these can provide clues about future market conditions.

In conclusion, understanding the current financial landscape, including key terms and market drivers, is essential for making informed investment decisions. By staying informed and adapting strategies, investors can navigate these complex conditions effectively.