—

## Understanding China’s Recent Bond Issuance

On November 5, 2025, China entered the international bond market with a significant issuance of $4 billion in US dollar-denominated bonds, divided into two equal tranches. The demand for these bonds was remarkable, with the orderbook peaking at an astonishing $161 billion before settling at $118 billion when the final pricing was announced. This indicates a robust appetite from investors, underscoring a potential shift in the global financial landscape.

### Pricing Dynamics: A Closer Look

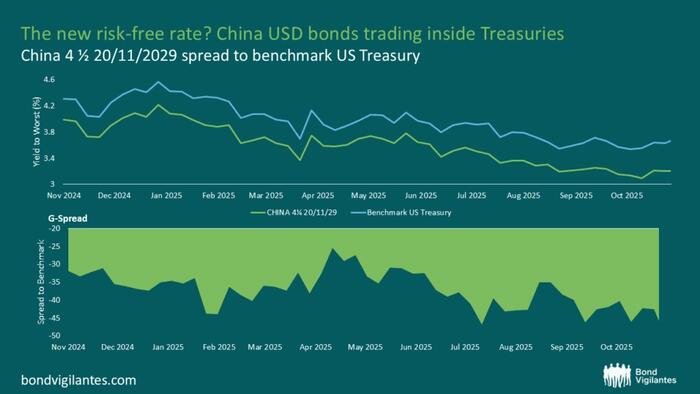

The bonds were priced at a spread to US Treasuries, with the 3-year tranche set at US Treasury + 0 basis points (bp) and the 5-year tranche at US Treasury + 2bp. Following the issuance, these bonds began trading significantly above their initial pricing, with quotes showing they were trading more than 30bp inside UST. In comparison, other high-credit quality sovereign issuers like South Korea, Abu Dhabi, and Qatar, all rated AA, typically trade at wider spreads, making China’s pricing structure particularly noteworthy.

### Why Is China Trading So Favorably?

The question arises: What makes China’s bonds so appealing, even with an A+ rating, which is lower than its AA-rated counterparts? One plausible explanation is the perceived instability of US financial institutions and the dollar’s weakening status, prompting investors to seek alternatives. Factors such as government shutdowns and tariff tensions have contributed to this perception, making China appear as a more stable investment option.

However, this argument may not hold water when examined closely. For instance, China had previously issued bonds in November 2024 at T+3bp, which have consistently traded 30bp or more inside UST, indicating that the current trend may not solely be a reaction to recent events.

## The Supply-Demand Imbalance

When fundamental factors fail to explain bond market trends, technical factors often come into play. China’s scarcity of external debt in USD is a key driver. With Chinese banks holding substantial US dollar deposits, the demand for USD-denominated assets is high. This situation creates a supply-demand imbalance favoring China’s bonds.

### The Role of Tax Rebates

Additionally, a complex tax rebate system for certain onshore bank clients enhances the attractiveness of Chinese bonds. This, combined with strong institutional interest—where central banks and sovereign wealth funds accounted for 26% of the orderbook—created favorable trading conditions. In fact, Asian investors represented 53% of the orderbook, further indicating regional confidence in Chinese bonds.

## Actionable Takeaways for Investors

1. **Diversify with Caution**: Given the potential for China to emerge as a new benchmark for risk-free assets, consider diversifying your portfolio to include Chinese bonds, especially if you are currently overexposed to US Treasuries.

2. **Monitor Economic Indicators**: Keep an eye on macroeconomic indicators in both the US and China. Changes in economic policy, interest rates, and geopolitical tensions can significantly impact bond performance.

3. **Evaluate Tax Implications**: If you’re considering investing in Chinese bonds, consult with a tax advisor to understand the implications of the tax rebate system and how it could enhance your returns.

4. **Stay Informed on Global Trends**: As the financial landscape evolves, stay updated on global market trends that could affect the perception of risk and the demand for various sovereign bonds.

## Conclusion: The Road Ahead for Chinese Bonds

While some analysts speculate that China could become the new risk-free rate benchmark, recent euro-denominated bond issuances do not reflect the same strong technical picture. As China plans to issue up to €4 billion in bonds, the dynamics may differ, indicating that the country has yet to fully cement its status as the go-to risk-free investment. Investors should remain vigilant and adaptable as the global financial environment continues to change.