—

### Introduction: A Controversial Revelation

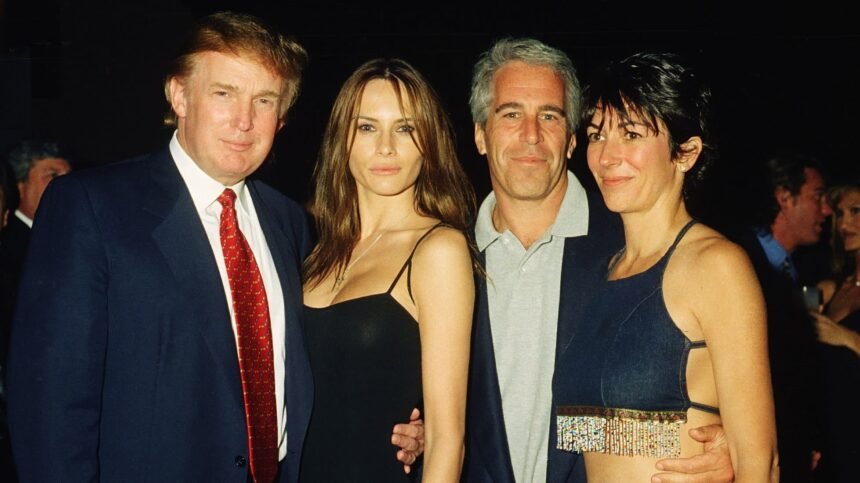

In a surprising turn of events, House Democrats have released new communications tied to a late individual with a troubling history. This development raises significant questions regarding his relationship with the current US president. As the political landscape evolves, understanding the potential financial implications of such revelations is crucial for investors and stakeholders alike.

### Understanding the Context

The communications in question involve a late individual who was previously convicted of serious crimes. The release of these documents has sparked a renewed debate about ethical conduct in politics. Investors should consider how political scandals can influence market stability and public confidence, which can ultimately affect stock prices and investment strategies.

### Key Terms Explained

1. **Communications**: Refers to emails, texts, or other forms of messaging between individuals. In this case, these communications are being scrutinized to understand the nature of the relationship between the late individual and the president.

2. **Political Scandal**: An event that can damage the reputation of political figures or institutions, often leading to public outcry and changes in policy or leadership.

3. **Market Stability**: The degree to which financial markets are resistant to sudden changes, which can be influenced by political events or scandals.

### The Causes: Why This Matters

The release of these communications is not just a matter of political intrigue; it has broader implications. The potential for a scandal can lead to increased scrutiny of the president’s administration, impacting legislative agendas and public trust. This, in turn, can affect economic policies and investor sentiment.

– **Investor Confidence**: Political stability is key for maintaining investor confidence. If the public perceives the president as compromised, it could lead to volatility in the markets.

– **Legislative Changes**: If this situation escalates, it may result in legislative gridlock as lawmakers focus on investigations rather than economic reforms, which could hinder growth.

### Potential Effects on the Financial Landscape

1. **Market Volatility**: Investors should be prepared for potential market swings as news breaks and public reactions unfold. Keeping a close eye on market trends during politically charged moments can be crucial for making informed investment decisions.

2. **Sector-Specific Impacts**: Certain sectors, such as defense or healthcare, may experience more significant shifts based on the political fallout. For example, if the administration faces challenges in passing legislation, companies reliant on government contracts could be adversely affected.

3. **Long-Term Implications**: Scandals can have lasting effects on public policy and investor behavior. A decline in trust can lead to reduced consumer spending, which may slow economic growth and impact various sectors.

### Actionable Takeaways for Investors

1. **Stay Informed**: Regularly monitor news sources and financial analyses to understand the evolving situation. Knowledge is power, especially in the fast-paced world of finance.

2. **Diversify Investments**: To mitigate risks associated with political instability, consider diversifying your portfolio across different sectors and asset classes. This can help buffer against market volatility.

3. **Evaluate Political Risk**: Incorporate political risk assessments into your investment strategy. Understanding the political landscape can provide insights into potential market movements and help you make better-informed decisions.

4. **Consult Financial Advisors**: If you’re unsure how these developments may impact your portfolio, consulting with a financial advisor can provide personalized guidance tailored to your investment goals.

### Conclusion: Navigating Uncertainty

As House Democrats unveil new communications that raise questions about the president’s past associations, the financial ramifications of this political drama are far-reaching. Investors must remain vigilant, informed, and adaptable to navigate the uncertainties that lie ahead. By understanding the implications and taking proactive steps, you can better position yourself for success in a potentially turbulent market.