—

### The Passing of a Business Titan: A Look at the Hinduja Group

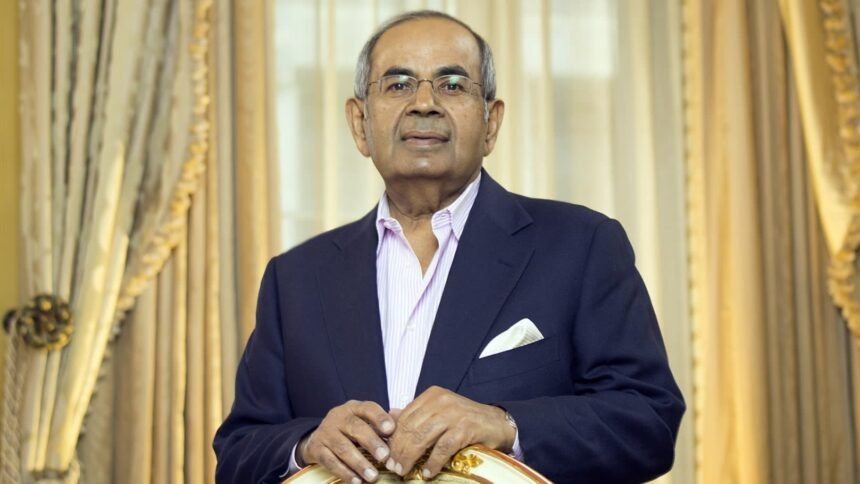

The recent passing of the billionaire industrialist from the Hinduja Group marks a pivotal moment not only for the family but also for the broader business landscape. Known for their extensive interests ranging from banking to healthcare, the Hinduja Group has been a significant player in various industries. Understanding the implications of this loss is crucial for investors and stakeholders alike.

### Who Was the Hinduja Heir?

The deceased was part of a family dynasty that founded the Hinduja Group, a conglomerate with a diverse portfolio. The family’s wealth is largely attributed to their strategic investments and business acumen, which have allowed them to thrive in various sectors, including automotive, energy, and finance. His leadership role within the company has been instrumental in its growth and globalization.

### Causes of Death and Its Immediate Impact

After a prolonged illness, the billionaire’s passing has raised questions about the future leadership of the Hinduja Group. The immediate effect is a potential disruption within the organization as the company navigates the transition of leadership. Investors may experience uncertainty as they assess the management capabilities of the next generation.

### The Broader Economic Implications

The Hinduja Group is not just a family business; it plays a critical role in the economies of the countries where it operates. The death of its leader could have several ramifications:

1. **Market Volatility**: The uncertainty surrounding leadership transitions often leads to fluctuations in stock prices. Investors should monitor the Hinduja Group’s financial performance closely in the coming weeks.

2. **Strategic Partnerships**: The group’s existing partnerships and future deals may be affected. Key stakeholders might reassess their relationships with the company during this period of transition.

3. **Industry Influence**: The Hinduja Group is influential in sectors such as finance and energy. Changes in its leadership could influence market dynamics, potentially affecting competitors and collaborators.

### What Investors Should Consider

For those involved in or considering investments in the Hinduja Group, here are some actionable takeaways:

– **Stay Informed**: Keep abreast of news related to the leadership transition. Understanding who will take the reins can provide insights into the company’s strategic direction.

– **Evaluate Financial Health**: Review the company’s financial statements and market performance. Look for indicators of resilience or vulnerabilities that may arise from this leadership change.

– **Diversify Investments**: Given the uncertainties associated with leadership transitions, consider diversifying your portfolio to mitigate risks. This could involve investing in other sectors or companies less affected by such changes.

– **Engage with Analysts**: Consult financial analysts who specialize in the sectors impacted by the Hinduja Group. Their insights can help you make informed decisions during this transition.

### Conclusion: A New Era for the Hinduja Group

The death of the Hinduja heir marks the end of an era for the family and its business empire. As the Hinduja Group approaches this transitional phase, stakeholders must remain vigilant and proactive. By understanding the implications of this loss and taking informed steps, investors can navigate the changing landscape effectively. The future may hold both challenges and opportunities for the Hinduja Group, and staying informed will be key to capitalizing on them.