—

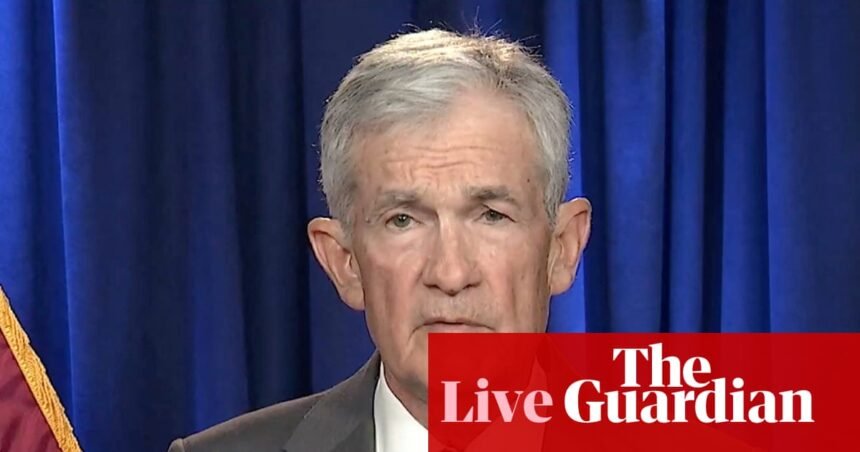

### Global Central Banks Unite in Support of Jerome Powell

In a significant move, central banks from around the globe have declared their unwavering support for Jerome H. Powell, the Chair of the U.S. Federal Reserve. This solidarity comes in the wake of recent threats of a criminal indictment against Powell, which has raised concerns about the independence of central banks and their ability to manage monetary policy effectively.

### Understanding the Context: What’s at Stake?

The Federal Reserve, often referred to as the Fed, plays a crucial role in the U.S. economy by regulating monetary policy, which includes controlling interest rates and managing inflation. Powell’s leadership has been pivotal, especially during turbulent economic times. However, the recent legal threats, reportedly from the Department of Justice, have put his position under scrutiny, creating uncertainty in financial markets.

The potential indictment is seen as an unprecedented challenge to the independence of the Fed. Central bankers worldwide are aware that if political pressures can influence the Fed, it could set a dangerous precedent that undermines the credibility of central banks everywhere.

### The Global Response: Solidarity Among Central Banks

In response to these developments, central bank officials are gearing up to release a coordinated statement of support for Powell. This statement is expected to underscore the importance of maintaining independent central banks, free from political interference. The backing from global counterparts highlights a collective understanding that a strong, independent Fed is essential for economic stability not just in the U.S., but globally.

### Causes and Effects: The Broader Implications

The threats against Powell are rooted in broader political dynamics, particularly the contentious relationship between the Federal Reserve and certain political figures. The potential ramifications of this situation are significant:

1. **Market Volatility**: Uncertainty surrounding Powell’s position could lead to increased volatility in financial markets. Investors typically prefer stability, and any indication that the Fed’s independence is compromised could trigger sell-offs in equities and bonds.

2. **Interest Rate Decisions**: The Fed’s ability to make decisions on interest rates could be impacted. If Powell faces legal challenges, it may affect his capacity to lead the Fed effectively, leading to concerns over future monetary policy direction.

3. **Global Economic Impact**: Given the Fed’s influence on global financial markets, any disruption could have ripple effects worldwide. Other central banks may need to adjust their strategies in response to changes in U.S. monetary policy, impacting exchange rates and international trade.

### Actionable Takeaways for Investors

1. **Monitor Market Reactions**: Investors should keep a close eye on market movements as news unfolds. Increased volatility may present both risks and opportunities for savvy traders.

2. **Diversify Investments**: Given the uncertainty surrounding U.S. monetary policy, consider diversifying your portfolio to mitigate risks associated with potential market fluctuations.

3. **Stay Informed**: Keeping abreast of developments regarding Powell’s situation and the broader implications for the Fed will be crucial. Understanding the nuances of monetary policy can help investors make more informed decisions.

4. **Engage with Financial Advisors**: For those unsure about navigating this complex landscape, consulting with financial advisors can provide personalized strategies tailored to individual risk tolerance and investment goals.

### Conclusion: The Importance of Independent Central Banking

The solidarity expressed by global central banks serves as a reminder of the critical role that independent institutions play in maintaining economic stability. As the situation with Jerome Powell unfolds, the financial world will be watching closely, recognizing that the foundations of monetary policy are intertwined with the principles of independence and integrity.