**SEO_TITLE:** Germany’s Debt Strategy: A Cautionary Tale of Bureaucracy Over Growth

**META_DESC:** Explore how Germany’s recent debt strategy, aimed at economic revival, has instead fueled bureaucracy and stagnation. Discover the implications for investors and policymakers.

**TAGS:** Germany, debt strategy, economic growth, bureaucracy, investment, ECB, fiscal policy

—

### Germany’s Debt Strategy: A Cautionary Tale of Bureaucracy Over Growth

Germany is currently facing an economic crossroads as the federal government aggressively pursues a debt-driven strategy to combat recession. However, early indicators suggest that this approach may be more about expanding bureaucracy than fostering genuine economic growth. Understanding the implications of this strategy is essential for investors and policymakers alike.

### The Debt-Fueled Investment Offensive

In March, the German government initiated a significant investment plan, launching a special fund expected to raise €500 billion over the next decade. This plan involves issuing new bonds annually, with maturities ranging from five to thirty years, amounting to €50 billion each year. The objective is to finance infrastructure projects, particularly those aligned with climate neutrality.

However, a substantial portion of this funding is likely to be redirected to cover existing social fund deficits. This raises critical questions about the efficacy of the plan, as it appears to prioritize short-term political gains over sustainable economic development.

### The Keynesian Approach: Causes and Effects

The current strategy reflects a classic Keynesian approach, which emphasizes increasing state demand to stimulate economic activity. Unfortunately, this has led to a concerning trend: growing public debt and the displacement of private investment in capital markets. With real interest rates from the European Central Bank (ECB) now negative, the environment is ripe for borrowing—yet the results have been disappointing.

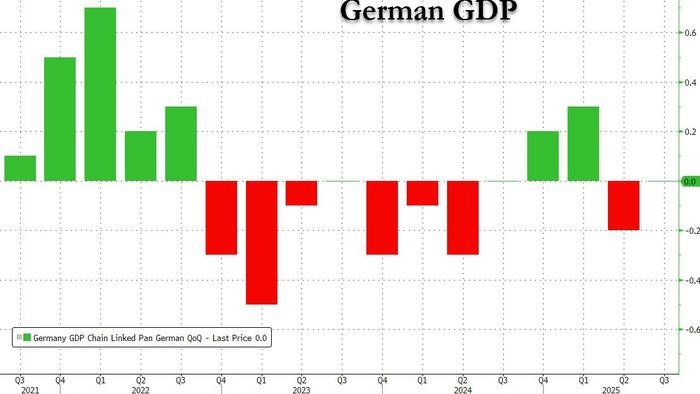

Despite the influx of debt, economic growth has stagnated. The latest reports indicate that Germany’s GDP growth has come to a standstill, raising alarms about the effectiveness of this debt-driven strategy. With public debt now at 4.7% of GDP and the state’s share exceeding 50%, the private sector is effectively being squeezed out of the market, which may explain the zero-growth outcome.

### The Bureaucratic Burden

As the government pursues its aggressive fiscal strategy, it inadvertently expands the bureaucratic apparatus. The President of the Employers’ Association, Rainer Dulger, has highlighted the alarming trend: over the last three years, 325,000 new bureaucratic positions have been created to manage these growing demands. This increase in bureaucracy not only stifles productivity but also diverts resources away from more productive sectors of the economy.

The significant costs associated with compliance—stemming from regulations like the General Data Protection Regulation (GDPR) and various EU directives—are further hampering economic growth. These costs are often not reflected in GDP calculations, masking the true extent of the bureaucratic burden on the economy.

### A Vicious Cycle of Debt and Inefficiency

Germany’s current strategy has created a vicious cycle: debt is used to fund an expanding bureaucracy, which in turn stifles economic growth. This approach has been criticized as a “poverty program,” where the government attempts to breathe life into a stagnant economy through unsustainable means. The political motivation behind this strategy—aiming to create a temporary economic boost before upcoming elections—only adds to the concern.

### Actionable Takeaways for Investors and Policymakers

1. **Monitor Regulatory Changes:** Investors should keep a close eye on regulatory developments that may impact the business landscape in Germany. Increased bureaucracy can lead to unexpected costs and inefficiencies.

2. **Evaluate Investment Opportunities:** With public funds increasingly directed toward bureaucratic management rather than productive investments, investors should consider sectors that are less affected by government intervention.

3. **Advocate for Sustainable Policies:** Policymakers should focus on creating an environment that encourages private investment and productivity rather than relying solely on state-driven initiatives. Sustainable growth requires balancing fiscal responsibility with innovation.

4. **Prepare for Long-Term Implications:** The current trajectory suggests that future generations may bear the brunt of today’s debt decisions. Both investors and policymakers must consider the long-term implications of excessive public debt on economic stability.

In conclusion, while Germany’s debt strategy aims to combat recession, it risks entrenching a cycle of bureaucracy and stagnation. Stakeholders must remain vigilant and proactive to navigate the challenges ahead.