—

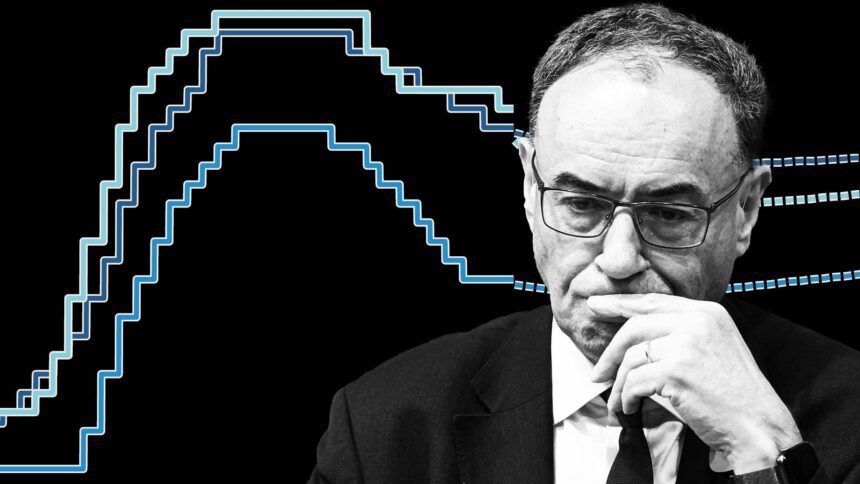

### Understanding Bailey’s Comments on Interest Rates

In a recent statement, Andrew Bailey, the Governor of the Bank of England, hinted that the UK may experience interest rates that are higher than those in the United States and the Eurozone. This assertion has significant implications for both consumers and investors, as it suggests a divergence in monetary policy between these major economies.

### What Are Interest Rates and Why Do They Matter?

Interest rates represent the cost of borrowing money. They are typically expressed as a percentage and can influence various aspects of the economy, including consumer spending, business investments, and overall economic growth. When interest rates are high, borrowing becomes more expensive, which can slow down spending and investment. Conversely, lower rates generally encourage borrowing and spending, stimulating economic activity.

### Causes of Higher Interest Rates in the UK

Bailey’s comments suggest that several factors may be contributing to the potential for higher interest rates in the UK:

1. **Inflation Concerns**: One of the primary reasons for raising interest rates is to combat inflation, which is the rate at which prices for goods and services rise. If inflation is higher in the UK than in the US or Eurozone, the Bank of England may need to increase rates to stabilize prices.

2. **Economic Recovery**: As the UK economy continues to recover from the impacts of the COVID-19 pandemic, demand for goods and services may rise, leading to increased inflationary pressure. This recovery could prompt the Bank of England to act more aggressively with interest rate hikes.

3. **Comparative Economic Strength**: If the UK economy is performing better than its counterparts in the US and Eurozone, it may justify higher interest rates. A stronger economy can support higher borrowing costs without stifling growth.

### Effects of Higher Interest Rates

The potential for higher interest rates in the UK could have several effects on different sectors of the economy:

– **Consumers**: Higher interest rates could lead to increased mortgage and loan costs for consumers. Homebuyers may face more expensive mortgage payments, while existing borrowers might see their variable-rate loans become pricier. This could lead to reduced consumer spending, as households allocate more of their budgets to debt repayments.

– **Investors**: For investors, higher interest rates can affect stock market performance. Typically, when rates rise, bond yields increase, making fixed-income investments more attractive compared to stocks. Investors may need to reassess their portfolios, potentially shifting funds from equities to bonds to mitigate risk.

– **Business Investments**: Companies may also react to higher borrowing costs by slowing down expansion plans. Increased interest expenses can lead firms to delay or scale back investments, which could hinder economic growth in the long term.

### Actionable Takeaways for Investors and Consumers

1. **Review Your Debt**: Consumers should consider reviewing their existing debts, especially variable-rate loans, to understand how potential interest rate hikes may impact their monthly payments. It may be beneficial to lock in fixed rates if possible.

2. **Adjust Investment Strategies**: Investors should evaluate their portfolios in light of the potential for rising interest rates. Diversifying into bonds or other fixed-income securities may provide a hedge against stock market volatility.

3. **Stay Informed**: Keep an eye on economic indicators such as inflation rates and the Bank of England’s policy announcements. Understanding these factors can help you make informed decisions about spending, saving, and investing.

### Conclusion

Andrew Bailey’s comments on the potential for higher interest rates in the UK signal a shift in the financial landscape that could have wide-reaching implications. By understanding the causes and effects of these changes, consumers and investors can take proactive steps to navigate the evolving economic environment effectively.