**SEO_TITLE:** Understanding the Impact of Food Stamp Benefits for Non-Citizens Amid Government Shutdown

**META_DESC:** As the federal government shutdown continues, millions of Americans face potential cuts to food stamps. Discover how non-citizens are also affected and what this means for taxpayer dollars.

**TAGS:** Food Stamps, Non-Citizens, SNAP, Federal Government Shutdown, Immigration Policy, Taxpayer Impact

—

### Overview of Food Stamp Benefits During the Shutdown

As the U.S. government shutdown looms, the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, is at risk of significant reductions. While the focus has largely been on the 42 million American citizens who depend on this program, non-citizens also represent a substantial demographic receiving these benefits.

### The Non-Citizen Demographic: Key Statistics

Recent data from the Economic Policy Innovation Center (EPIC) indicates that approximately 1.5 million non-citizens received food stamps in fiscal year 2022. Additionally, around 2.2 million children living with non-citizens were enrolled in the program. This raises concerns about the financial implications for taxpayers, as these benefits totaled an estimated $4.2 billion.

**Actionable Takeaway:** Stakeholders should monitor the evolving landscape of SNAP benefits, especially as government policies and funding can change rapidly during shutdowns.

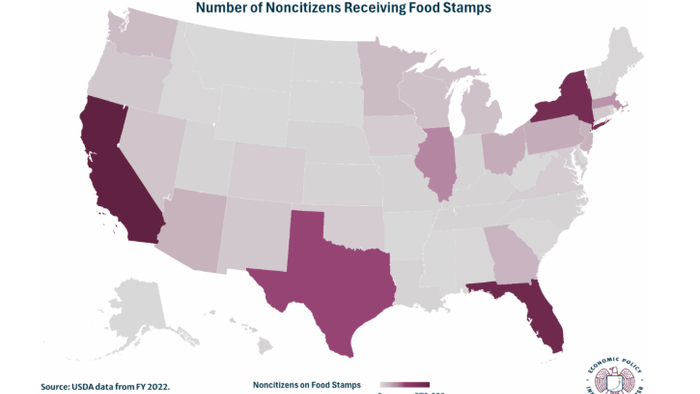

### Geographic Distribution of Non-Citizen Recipients

California, Florida, New York, Texas, and Illinois lead the states with the highest numbers of non-citizen food stamp recipients. For instance, California reported 273,000 non-citizen beneficiaries, followed closely by Florida with 238,000. In contrast, states like Delaware and Wyoming reported no non-citizen recipients, highlighting significant geographic disparities.

**Actionable Takeaway:** Investors and policymakers should consider regional variations in SNAP enrollment when assessing state budgets and potential fiscal impacts.

### Public Charge Policies and Their Implications

Traditionally, U.S. public charge policies expect immigrants to be self-sufficient and not rely on government assistance. However, recent changes in policy have allowed some non-citizens to qualify for SNAP benefits through various legal statuses, such as parole or deferred deportation.

The Congressional Budget Office (CBO) estimates that, due to current immigration policies, illegal immigrants and their children could receive up to $15 billion in food stamp benefits by fiscal year 2024.

**Actionable Takeaway:** Investors and businesses should remain aware of how immigration policies can affect labor markets and consumer spending, given the potential for increasing government expenditures.

### The Political Landscape

The ongoing government shutdown has positioned food stamp funding as a contentious political issue. Democrats have been advocating for the restoration of taxpayer-funded health insurance for non-citizens, a move that has met resistance from Republicans. This conflict underscores the broader debate over immigration and social welfare programs in the U.S.

### Fiscal Impact of Non-Citizen Benefits

Research indicates that illegal immigrants contribute less in taxes than they receive in government services, marking them as a net fiscal drain. As the debate continues, some argue that reducing benefits for non-citizens could lead to a decrease in their numbers in the U.S., while others see it as a necessary step to protect taxpayer interests.

**Actionable Takeaway:** Financial analysts and policymakers should closely monitor the fiscal impact of welfare programs on the federal budget, especially in light of changing immigration policies and public sentiment.

### Conclusion: The Road Ahead

As the government shutdown unfolds, the future of SNAP and its beneficiaries—both citizens and non-citizens—remains uncertain. With potential cuts looming, it is crucial for stakeholders to stay informed about the implications of these changes. Understanding the dynamics of food stamp enrollment, the political landscape surrounding immigration, and the fiscal ramifications will be vital for making informed decisions moving forward.

In summary, the interplay of immigration policy and welfare programs will not only impact individual lives but also shape the financial landscape of the nation.