—

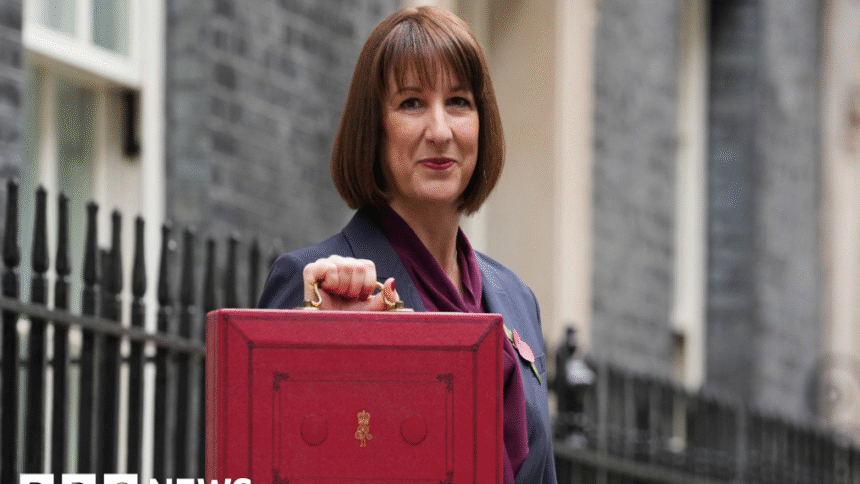

# Chancellor Rachel Reeves Considers Tax Increases and Spending Cuts

As the UK approaches the crucial Budget announcement on November 26, Chancellor Rachel Reeves is faced with tough decisions that could shape the economic landscape for years to come. The potential for both tax increases and spending cuts has raised concerns and expectations among investors and economists alike. Let’s break down what this means and what you should consider moving forward.

## Understanding the Context: Why Tax Increases and Spending Cuts?

The UK economy has been under pressure due to various factors, including rising inflation, sluggish growth, and increased public spending during the pandemic. To address these challenges, the Chancellor is contemplating measures that could stabilize the economy while also preparing for future growth.

**Tax Increases:** Tax increases can stem from the need to generate additional revenue for public services and to reduce national debt. If implemented, these changes could affect everything from income tax rates to corporate taxes, impacting both individuals and businesses.

**Spending Cuts:** On the other hand, spending cuts could be necessary to rein in government expenditures. This might involve reducing funding for public services such as healthcare, education, or infrastructure projects. While this can help balance the budget, it can also lead to public discontent and slower economic growth.

## Potential Causes and Effects

### Causes

1. **Rising Inflation:** The UK has been grappling with high inflation, which erodes purchasing power and increases the cost of living. This puts pressure on households and businesses, prompting the government to consider fiscal adjustments.

2. **Public Debt:** The economic fallout from the COVID-19 pandemic has led to significant increases in public debt. To ensure long-term fiscal health, the government may need to find ways to reduce this burden.

3. **Economic Growth Challenges:** With growth slowing, the government faces the dual challenge of stimulating the economy while maintaining fiscal responsibility.

### Effects

1. **Consumer Spending:** If taxes rise significantly, consumers may have less disposable income, leading to reduced spending. This could further slow economic growth, creating a feedback loop that exacerbates the situation.

2. **Business Investment:** Higher corporate taxes could deter investment, as companies may have less capital to reinvest in growth initiatives. This could impact job creation and innovation.

3. **Public Services:** Spending cuts can lead to reduced funding for essential services, which might not only affect the quality of life for citizens but also lead to longer-term economic consequences as education and health services are compromised.

## Actionable Takeaways for Investors

1. **Stay Informed:** Keep an eye on announcements from the Treasury as the Budget date approaches. Understanding the specifics of tax changes can help you make informed investment decisions.

2. **Evaluate Sector Exposure:** Certain sectors may be more sensitive to tax hikes or spending cuts. For example, consumer goods companies might be adversely affected by reduced consumer spending, while infrastructure firms could face challenges if public spending is curtailed.

3. **Consider Defensive Investments:** In times of fiscal uncertainty, defensive stocks—those that provide stable earnings regardless of economic conditions, such as utilities or consumer staples—can be a safer bet.

4. **Monitor Interest Rates:** Tax increases could influence monetary policy. If the government moves to tighten fiscal policy, the Bank of England may adjust interest rates, impacting borrowing costs and investment returns.

5. **Engage with Financial Advisors:** With potential changes on the horizon, consulting with financial advisors can help you navigate the complexities of your portfolio and ensure it aligns with your risk tolerance and investment goals.

## Conclusion

Chancellor Rachel Reeves’ considerations for tax increases and spending cuts signal a pivotal moment for the UK economy. Understanding the causes and potential effects of these decisions is essential for investors looking to navigate the upcoming economic landscape effectively. By staying informed and adjusting strategies accordingly, you can better position yourself to weather any storms that may arise from the November Budget.